Key Takeaways:

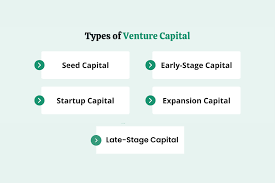

- Different stages of a business require different types of venture capital.

- Angel investors and seed funding are essential for early-stage growth.

- Growth and expansion can be supported by Series A, B, and C funding.

Introduction

In the vibrant ecosystem of startups and entrepreneurship, accessing the right type of venture capital can propel a business from a mere concept to a market leader. Beyond being a source of funds, venture capital acts as a catalyst for innovation, empowering entrepreneurs to bring groundbreaking products and services to life. Understanding the intricacies of venture capital and selecting the appropriate type for your business stage is crucial, and experts such as John Avirett exemplify how strategic investments can usher in remarkable business transformations.

The realm of venture capital is diverse, encompassing various funding stages that cater to businesses’ different needs as they grow. These stages offer more than just financial backing; they come with strategic guidance, market access, and invaluable networking opportunities, which are essential for sustaining competitive advantage and driving substantial growth.

The Role of Venture Capital

Venture capital bridges the gap between innovative ideas and their successful market realization. It provides entrepreneurs the resources needed to navigate competitive landscapes and achieve scalability. While traditional financing methods may be risk-averse or inflexible, venture capitalists are typically more inclined to invest in high-risk, high-reward ventures. This characteristic makes venture capital a cornerstone of the startup ecosystem.

Furthermore, venture capitalists often bring expertise to the table, whether in strategic planning, market expansion, or operational efficiency, which can be just as valuable as the capital. For startups striving to maintain agility and responsiveness in dynamic markets, this combination of venture capital and expert guidance can be decisive, ensuring sustained growth and long-term viability.

Seed and Angel Investors

At a startup’s foundational stage, seed funding and angel investors are crucial for transforming ideas into tangible business ventures. Seed capital is typically the first official money that a business venture raises. It supports core activities like prototyping, market research, and initial product development. Angel investors, often high-net-worth individuals, provide this early-stage backing, driven by their belief in the business’s potential.

Aside from financial support, angel investors often provide startups with valuable resources such as industry connections, mentorship, and strategic advice. According to sources, angel investors tend to be more flexible with investment terms than traditional investors, allowing startups to develop and refine their business models without undue pressure. This initial phase sets the groundwork for future growth and attracts further funding rounds by demonstrating the startup’s viability and potential.

Series A Funding

Once a startup has moved beyond the conceptual phase, demonstrated product-market fit, and earned initial revenue, Series A funding becomes a pivotal step. This funding stage is focused on optimizing product offerings and scaling operations to meet market demands more effectively. Series A investors offer more than just capital; they become partners in business development, helping to fine-tune the business model.

Typically, Series A funding aims to strengthen the company’s market presence. This involves expanding the company’s team, enhancing sales and marketing efforts, and improving operational efficiency. The strategic input from these investors is instrumental in navigating the complexities associated with larger-scale operations, which prepares the company for further growth stages and future funding rounds.

Series B and Beyond

After establishing a secure footing in its industry, a business may seek Series B funding and further rounds to continue its expansion. Series B funding is aimed at scaling the company to meet growing demands and increasing market competition. Funding at this stage involves enhancing business processes, diversifying product lines, and expanding market reach.

The guidance from investors during Series B and successive rounds such as Series C is critical as businesses face more intricate challenges like mergers, acquisitions, or entering international markets. Intellectual capital from these investors can drive strategic decisions, optimize complex business structures, and help execute expansive growth strategies effectively. An article highlights the benefits of strategic investor involvement at this stage, ensuring that businesses are well-equipped to capitalize on large-scale opportunities.

Choosing the Right Venture Capital

Choosing the appropriate type of venture capital is as important as securing the funding. It requires thoroughly understanding your business’s current stage, future goals, and what you hope to achieve with the investment. Entrepreneurs should meticulously evaluate potential investors, ensuring an alignment between the investors’ vision and the business’s. Strategic partnerships formed through venture capital can fundamentally impact business trajectories, underlining the importance of selecting investors who meet financial needs and are conducive to achieving broader business objectives.

The right type of venture capital aligns with your business’s core values and strategic vision, facilitating not only the financial capacity to execute plans but also offering the expertise necessary to pivot and adapt to market changes. Harnessing this synergy can translate to sustainable growth and a robust competitive stance.

Conclusion

Venture capital comprises diverse funding stages tailored to different business requirements, facilitating the transition from startup to established enterprise. From angel investors who nurture emerging ideas, to Series C backers who bolster market leadership, each type of funding plays a distinctive role in the business lifecycle. Recognizing and leveraging these opportunities allows entrepreneurs to drive innovation, scale effectively, and secure their place in the market. When deftly managed, venture capital serves as a means to an end and a powerful engine for enduring business success.

Keep an eye for more news & updates on TimesAnalysis!